Often, the current ratio tends to also be a useful proxy for how efficient the company is at working capital management. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

- Microsoft Excel provides numerous free accounting templates that help to keep track of cash flow and other profitability metrics, including the liquidity analysis and ratios template.

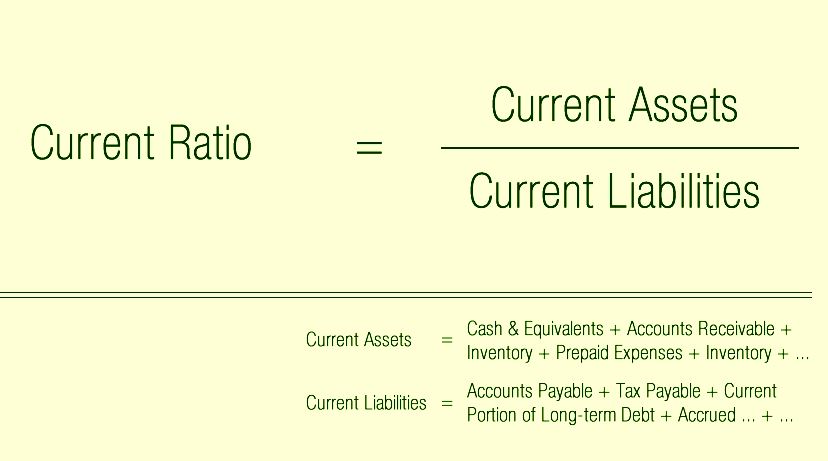

- Since the current ratio compares a company’s current assets to its current liabilities, the required inputs can be found on the balance sheet.

- She has worked in multiple cities covering breaking news, politics, education, and more.

- The cash ratio measures your company’s ability to cover short-term obligations using only cash and cash equivalents.

- The current ratio is an evaluation of a company’s short-term liquidity.

- The simple intuition that stands behind the current ratio is that the company’s ability to fulfill its obligations depends on the value of its current assets.

Company

When analyzing a company’s liquidity, no single ratio will suffice in every circumstance. It’s important to include other financial ratios in your analysis, including both the current ratio and the quick ratio, as well as others. More importantly, it’s critical to understand what areas of a company’s financials the ratios are excluding or including to understand what the ratio is telling you. The current cash debt coverage ratio is an advanced liquidity ratio. It measures how capable a business is of paying its current liabilities using the cash generated by its operating activities (i.e., money your business brings in from its ongoing, regular business activities). In this example, Company A has much more inventory than Company B, which will be harder to turn into cash in the short term.

Current Ratio Vs Quick Ratio

Company A has more accounts payable, while Company B has a greater amount in short-term notes payable. This would be worth more investigation because it is likely that the accounts payable will have to be paid before the entire balance of the notes-payable account. Company A also has fewer wages payable, which is the liability most likely to be paid in the short term. Finally, the operating cash flow ratio compares a company’s active cash flow from operating activities (CFO) to its current liabilities.

Frequently Asked Questions About the Current Ratio

You may note that this ratio of Thomas Cook tends to move up in the September Quarter. Secondly, we must identify the current liabilities, which encompass the company’s debts and obligations due within a year, such as accounts payable and short-term loans. The denominator in the Current Ratio formula, current liabilities, includes all the company’s short-term obligations, i.e., those due within one year. It encompasses items such as accounts payable, short-term loans, and any other debts requiring repayment in the near future. Current assets, which constitute the numerator in the Current Ratio formula, encompass assets that are either in cash or will be converted into cash within a year.

The power of the quick ratio in financial analysis

If a company’s ratio is too high, that can mean it may be leaving too much money on hand. In this case, it may not be fully using its workable assets to continue to grow. But just because a company doesn’t need money today doesn’t mean it won’t do a financing.

The Top Trucking Accounting Software

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

A quick ratio of 2.0 shows that your company has twice as many liquid assets as needed to cover its short-term liabilities. Your company has R500,000 in current assets, R100,000 in inventory, and R200,000 in current liabilities. Since the current ratio includes inventory, it will be high for companies that are heavily involved in selling inventory. For example, in the retail industry, a store might stock up on merchandise leading up to the holidays, boosting its current ratio. However, when the season is over, the current ratio would come down substantially. As a result, the current ratio would fluctuate throughout the year for retailers and similar types of companies.

The best long-term investments manage their cash effectively, meaning they keep the right amount of cash on hand for the needs of the business. This is once again in line with the current ratio from 2021, indicating that the lower ratio of 2022 was a short-term phenomenon. By leaving a comment on this article, you consent to your comment being made publicly available and visible at the bottom of the article on this blog. For more information on how Sage uses and looks after your personal data and the data protection rights you have, please read our Privacy Policy.

Such purchases require higher investments (generally financed by debt), increasing the current asset side. Various factors, such as changes in a company’s operations or economic conditions, can influence it. Monitoring a company’s Current Ratio over time helps in assessing its financial trajectory. For instance, if a company’s Current Ratio was 2 last year but is 1.5 this year, it may suggest that its liquidity has slightly decreased, which could be a cause for further investigation. The quick ratio (also sometimes called the acid-test ratio) is a more conservative version of the current ratio.

This means that a company has a limited amount of time in order to raise the funds to pay for these liabilities. Current assets like cash, cash equivalents, and marketable securities can easily be converted into cash in the short term. This means that companies with larger amounts of current assets will more tax calculator: how federal income tax works easily be able to pay off current liabilities when they become due without having to sell off long-term, revenue generating assets. Both of these indicators are applied to measure the company’s liquidity, but they use different formulas. The current ratio is one of the most popular liquidity ratios.

It refers to the ratio of current assets to current liabilities. For example, a company’s current ratio may appear to be good, when in fact it has fallen over time, indicating a deteriorating financial condition. But a too-high current ratio may indicate that a company is not investing effectively, leaving too much unused cash on its balance sheet. Companies may use days sales outstanding to better understand how long it takes for a company to collect payments after credit sales have been made. While the current ratio looks at the liquidity of the company overall, the days sales outstanding metric calculates liquidity specifically to how well a company collects outstanding accounts receivables.