Should you get a credit card that provides spectacular advantages or point redemption expertise, look out such notes commonly include higher APRs. In the event your credit grants you money back towards the the purchases, take a trip perks or any other high incentives, you will likely end up with a high Annual percentage rate so you can be the cause of those individuals can cost you.

Place

Venue has an effect on their Annual percentage rate too, particularly if you get an interest rate. Some other says and you can regional governments possess differing regulations that’ll impact fees or any other some costs might avoid upwards expenses, hence changing the Annual percentage rate as well.

The case within the Credit Operate (TILA) demands loan providers to reveal the brand new Apr regarding a loan or borrowing from the bank cards up until the debtor is sign almost any price. If you find yourself shopping around getting credit cards, you need to be able to see upfront throughout the provide exactly what new Apr of each and every card is really so you could evaluate will cost you away from different lenders.

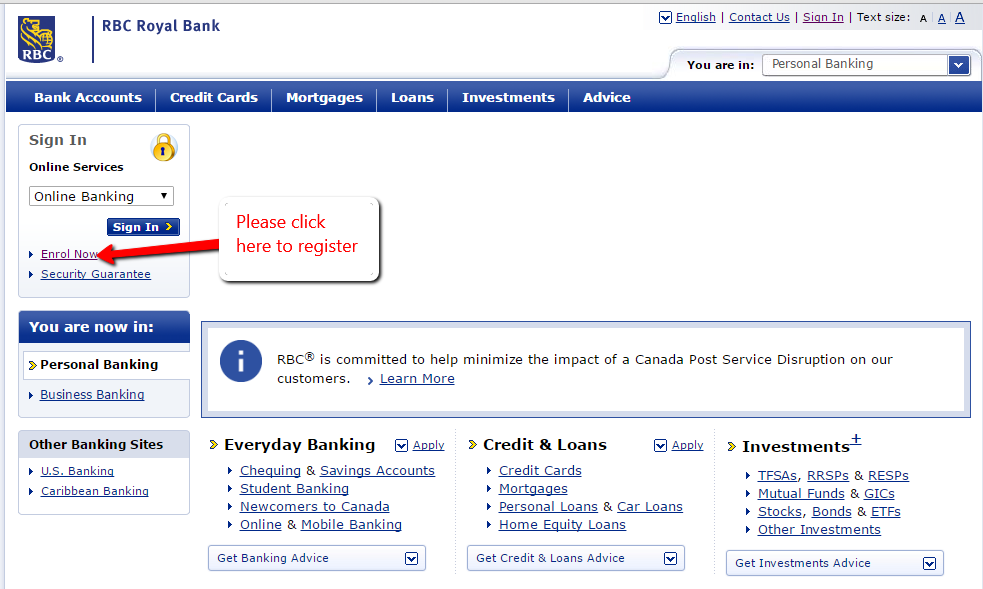

For many who already have credit cards and you are uncertain exactly what your Annual percentage rate try, you will find some methods read. It should be listed on your month-to-month statement, but you can along with see it from the signing in the membership online and seeing the information of line of credit.

The thing that makes Your own Annual percentage rate Highest?

For people who searched the brand new Annual percentage rate in your bank card or mortgage away from fascination and you may was basically astonished at how highest it actually was, you’re not alone. Of numerous individuals is baffled why its Apr try large than simply they imagine it needs to be. Let us review several causes your rate might be large.

Loan Form of

When you yourself have a loan, it may incorporate increased ple, personal loans for example certain signature loans often have large APRs because the they’re not supported by any collateral. Secured loans, while doing so, constantly come with straight down APRs since financing try backed by an article of your residence, such as for instance property otherwise auto, that may be captured and you may offered should you neglect to create costs.

Handmade cards often have highest age reason since the unsecured loans: there’s nothing in position to show you’re build your costs on time. You’ll find such things as secure credit cards, yet not, that https://paydayloanalabama.com/abanda/ enable you to prepay your own line of credit count for your bank to hang because the equity. Because your financial has an approach to recover their loss, if you end and also make money, such notes tend to have lower APRs.

Having said that, mastercard pick Apr won’t also count for those who shell out the balance out of completely monthly since you will never be charged for the a flowing harmony.

Lower Credit score

If you have imperfect credit, your credit score could be leading to a high Apr. Your credit score shows loan providers how you’ve handled your debts in going back, while your financial records could have been a tiny rugged, lenders may only be considered your to have playing cards and loans that have high Apr and come up with right up to the financing risk.

Debt Stream

Lenders along with look at your debt-to-money proportion, or DTI, to determine your own Apr. The DTI steps just how much loans you really have when compared with how much money you are taking domestic at the end of the newest go out. When you have excessively obligations, loan providers may be reduced ready to allow you to borrow money as you may be prone to neglect to build costs. Very lenders favor that the DTI are underneath the forty% diversity, however it is crucial that you observe that the reduced the DTI, the reduced Annual percentage rate you’re given.