If you would like some cash available to you to alter your residence, consolidate debt otherwise buy college, you happen to be considering either a home guarantee loan otherwise an effective house security line of credit.

At Inclusion Economic, i work at our very own users every day to assist them get the bucks they want to meet the wants. One of many concerns we tune in to a great deal is:

Could there be a good HELOC calculator I can use to find out if a home guarantee credit line is right for my situation?

The good news is you to definitely calculating your house security is actually a great simple action to take. Once you have that count, you can imagine how much cash you are able to borrow and determine if a beneficial HELOC or home security financing excellent for you.

What exactly is House Equity?

When you’re a primary-big date homeowner or you’ve never thought a great HELOC in advance of, you might not know what home equity are so, why don’t we begin indeed there.

Home equity is conveyed since the a dollar count or an effective fee symbolizing the amount of your home you individual downright. The opposite contour (the new part of your residence you do not very own) is your loan-to-really worth ratio or LTV.

The equity of your home is really what a lender use to have equity by taking out a property equity financing or a beneficial HELOC. Put simply, the latest security secures the borrowed funds and you may decrease brand new lender’s chance.

How-to Estimate Home Collateral

- A current assessment of the residence’s market price.

- The latest a fantastic balance of one’s financial.

- The total of any other liens against your property, and second mortgages, money, design liens, taxation liens and you can courtroom judgments.

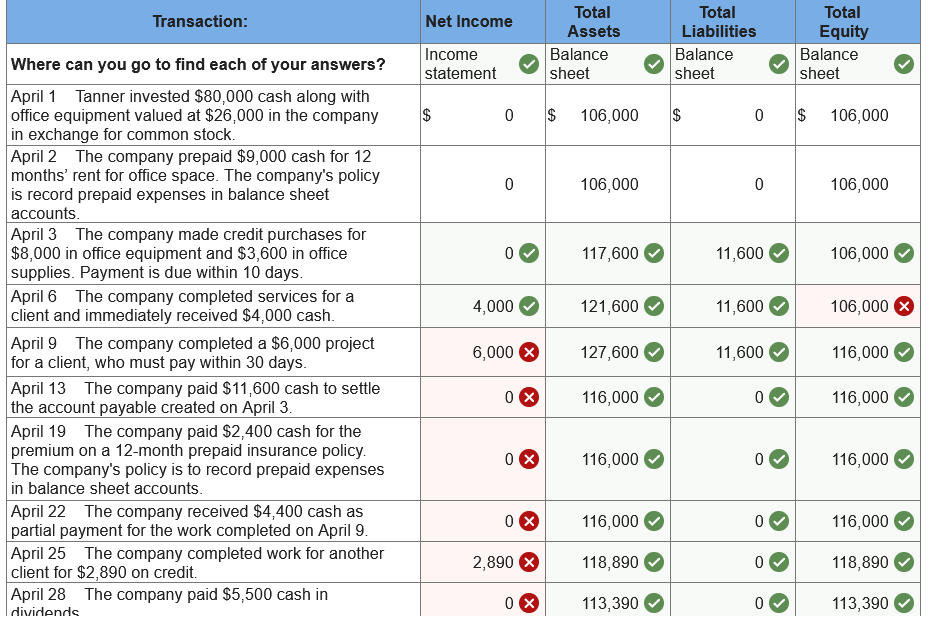

In order to discover, why don’t we glance at a good example. You own a property which is currently appraised during the $five-hundred,100. You made a great 20% down-payment on it and you will lent $400,100000. You have possessed our home for a while along with your most recent financing harmony are $350,000. Here is what new computation of one’s LTV manage seem like.

- $350,one hundred thousand (mortgage balance) / $five hundred,000 (latest assessment) = 70%

An enthusiastic LTV regarding 70% results in home equity from 30%. You might calculate your property security by firmly taking the buck number of your own security and splitting it by the residence’s latest appraised worth, like this:

- $150,000 (house equity) / $five-hundred,000 (newest appraisal) = 30%

If you had a great $ten,100 structure lien on the domestic, you would need to include you to definitely add up to your loan harmony. Your house equity carry out then end up being $140,100 / $five hundred,one hundred thousand otherwise 28%. In the event that you make use of your home because security otherwise people data files a lien to guard its economic passion, it impacts the amount of home collateral that one can obtain against.

Differences between property Equity Mortgage and a beneficial HELOC

To make the best decision regarding the whether or not a property guarantee mortgage otherwise a HELOC is right for you, you will have to see the differences when considering her or him. Here you will find the most critical what you need knowing:

- HELOCs has varying interest rates. Adjustable prices are typically considering a catalog plus an effective ple, Introduction Economic HELOCs depend on the top price.

- Household security financing routinely have a fixed speed, for example might spend i thought about this the money for exact same interest with the whole title of one’s loan. Which makes domestic guarantee funds predictable but it also implies that you won’t be able to make the most of decrease in the rates the manner in which you do having a beneficial HELOC.

- With a beneficial HELOC, you can withdraw the money you want when you need it. You’re not required to withdraw money and you will withdraw, pay off, and you can withdraw once again.