Dipping on an excellent 401k are going to be tempting.

- Email address icon

- Twitter icon

- Facebook icon

- Linkedin icon

- Flipboard symbol

Much of the present specialists won’t have retirement benefits to fall back towards within the earlier years. Given that we are into our own when you look at the resource our old age, what makes a lot of folks sabotaging our very own future coverage from the borrowing from your 401k agreements?

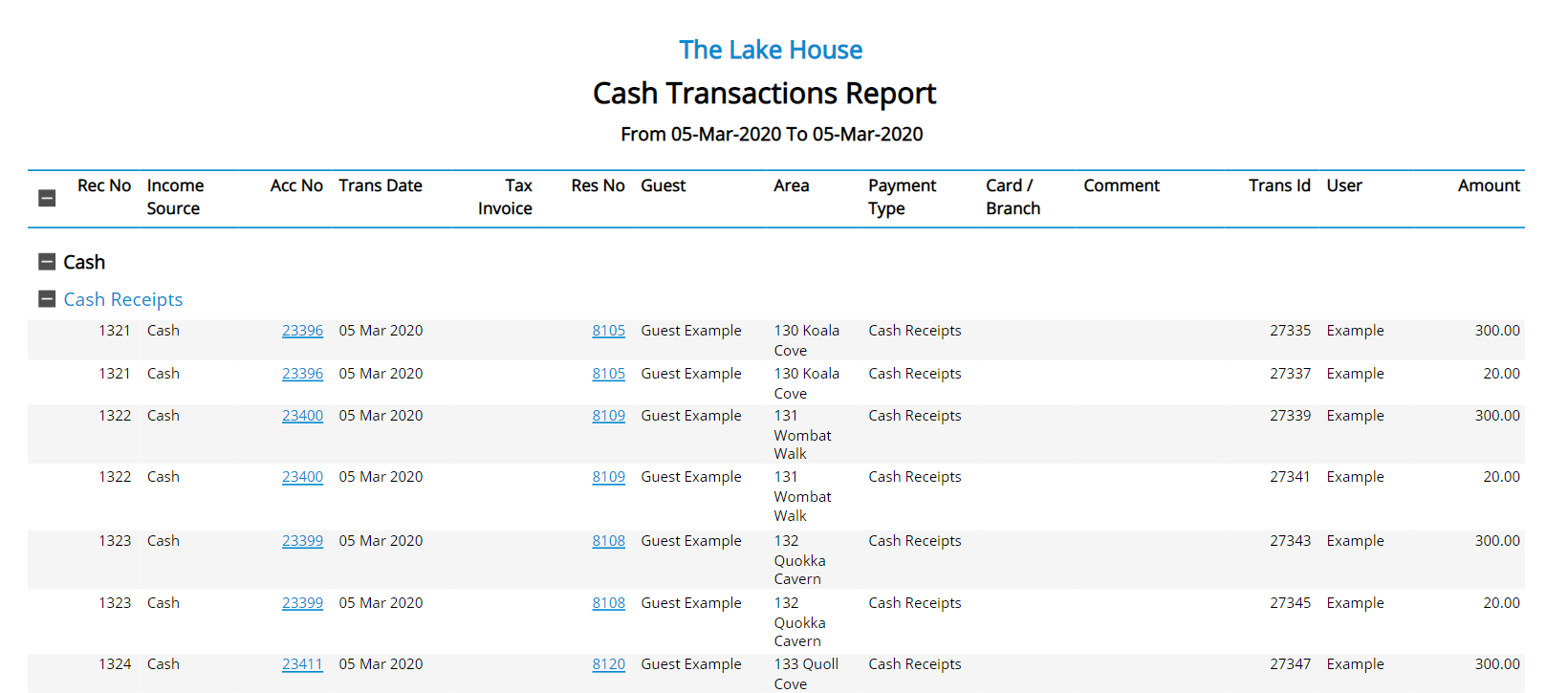

Merely more one out of four, or twenty-six%, off 401k professionals has actually that loan a fantastic, based on a recent declaration out-of Aon Hewitt, a benefits asking and you can administration agency. If you’re one to research didn’t grab the reasons why, an alternative you to presented just last year because of the TIAA-CREF found paying financial obligation are the main reason why somebody grabbed aside financing, with purchasing an emergency costs.

Whenever you are 401k borrowers is actually borrowing from the bank away from cashadvancecompass.com loan to pensioners themselves, this is simply not a benign import of cash from 1 pouch to help you some other, masters say. The best spin you could wear its it is the smaller many evils, said Greg McBride, chief economic analyst for Bankrate.

Whatsoever, very People in the us commonly sitting on 401k balances that they can afford to skim. Centered on Fidelity, an average 401k equilibrium was $91,300 at the conclusion of 2014. One share wouldn’t even safety an average retiree’s health-proper care will set you back, according to Fidelity’s individual prices. (An excellent 65-year-dated few retiring for the 2014 usually bear typically $220,100000 within the advancing years medical care can cost you, Fidelity methods.)

Consider the options

Certain 94% of middle and large-size of businesses make it finance towards the efforts team made on the 401k account, if you are 73% succeed fund to the contributions new employer made, based on Towers Watson, a specialist functions enterprise. Specific communities let gurus take out more than one financing in the a time.

The interior Cash Services generally restrictions a great participant’s bundle fund to a maximum of $fifty,100000 or 1 / 2 of this new participant’s vested equilibrium, any sort of are shorter. Basically, money have to exist in this five years, with attention your participant is beneficial themselves.

The program administrators need certainly to put a beneficial reasonable interest rate you to shows the current business speed for the same financing. Even when Irs advice promote examples where bundle trustees place mortgage showing sector-rates fund to your borrower’s borrowing from the bank character, pros state used of numerous agreements never glance at the individual’s creditworthiness and place a standard interest during the step 1% or 2% across the finest price, a standard that’s currently from the step three.25%.

Those offered a good 401(k) financing should compare the new rates they are able to log in to other types out-of money, including property security personal line of credit. If you have good borrowing, that will be a better choice than simply borrowing from the bank from the 401k, advantages state. Those with credit ratings below 680 will receive a lot fewer outside borrowing from the bank selection, and the ones which have results less than 620 will get difficulty borrowing at all, McBride told you.

Acknowledging the brand new downfalls

Borrowing from a 401k bundle exacts a huge opportunity cost. Consumers lose out on any compound increases one its investments manage if not deserve on the market. Of many package people possibly avoid causing the 401k or lose the sum during their loan, so that they in addition to miss out on the company match.

Except if the bucks are repaid rapidly, the loan means a long-term drawback so you can later years planning, McBride said. (There are lots of unusual exceptions, the guy notes. Eg, people that lent just before this new stock possess come out ahead after they reduced its mortgage. But that is perhaps not an example one to you can now expect otherwise package as much as.) Bankrate has a tool that exercise what kind of cash borrowers can also be be prepared to beat from 401k funds, offered specific assumptions.