I interviewed our from inside the-house loan officers locate his rapid-fire responses toward certain commonly requested questions about this new Virtual assistant Loan. This is the transcription:

Q1: The thing that makes the newest Va Mortgage very impactful in order to Vets and you can Active Responsibility?

Response: Feet about doorway, an average of homeowners has 44x more websites really worth than just tenants, its secured from the You authorities, Zero Down-payment necessary, No Mortgage Insurance policies expected particularly FHA or old-fashioned financial support over 80% Loan-To-Really worth (LTV). Overall, it will make wealth to own virtually no money up front.

Q2: Who is qualified to receive brand new Va Loan?

Response: Credit rating As low visit the website here as five hundred, Time in solution otherwise released to have a help-connected handicap…While in the war, that’s 90 straight active obligations days served, (in) peacetime 181 effective duty months offered, Effective Obligation 90 straight months, Reservist or Guard there are lots of affairs , such as for example six creditable many years, but there is in addition to an alternative Veterans Health care and you will Benefits Upgrade Operate detailed with va financing qualification shortly after a thirty day stint. Here is a comprehensive summary of Va mortgage eligibility.

Q3: How do you get a certificate of Eligibility?

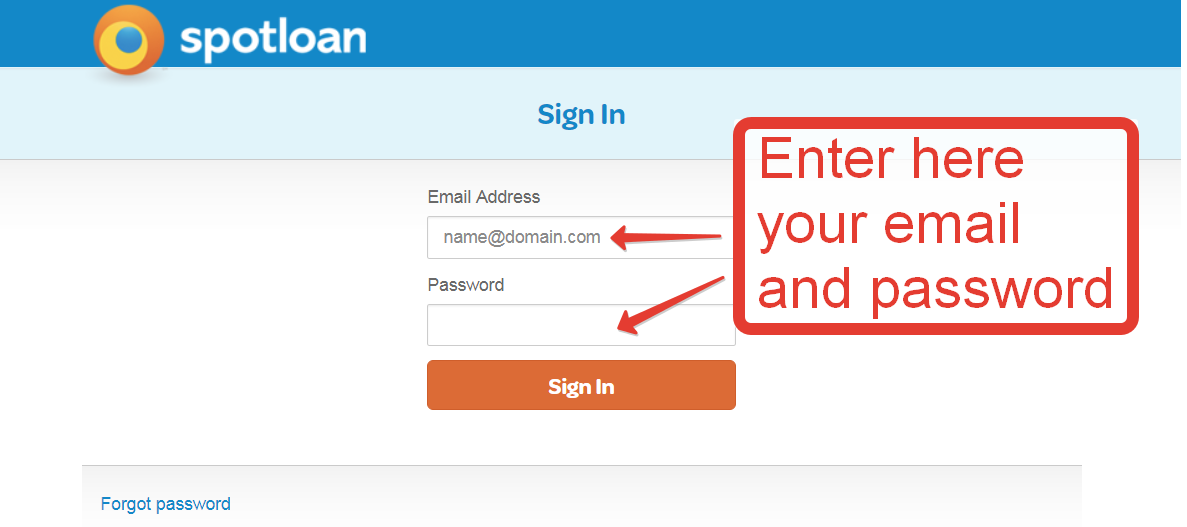

Response: Log into and you may proceed with the instructions or even easier, the fresh ADPI credit people might help remove it for you.

Q4: ‘s the Va Mortgage very 0% off?

Response: Yes. It could be. 100% Loan so you’re able to Worthy of (LTV), but you can still keeps settlement costs and you may a financing commission. The vendor could well be happy to pay for closing costs and you can new financing fee might be wrapped for the mortgage. And in case you have got a good 10% or even more handicap get, the brand new capital commission try waived. Discover best nine benefits associated with their Va mortgage.

Q5: Do you really manage a cash out Refinance away from a Virtual assistant Loan?

Response: Sure. it can increase in order to 100% of appraised really worth but most lender’s have top costs from the 90% Loan-To-Worth or faster. Nonetheless they still need to undertake home because first quarters. Find out more about Va loan refinancing.

Q6: Think about an increase protection re-finance? Virtual assistant IRRRL

Response: The interest rate avoidance refinancing mortgage can often be titled an enthusiastic IRRRL, pronounced Earl. It is only just what it seems like…that loan unit to attenuate the rate of good Virtual assistant loan. Brand new IRRRL features a 3 seasons recoupment code hence establishes total month-to-month offers out-of brand new payment to help you dated payment, split into the genuine costs sustained (virtual assistant financing percentage, financial and you can label charges, however, escrow design doesn’t matter). In addition it enjoys a 1 / 2 % interest rate decrease demands and you will have to be about 210 weeks from the time of very first commission or half a year, any is actually stretched.

Q7: Just how many Virtual assistant Money is also just one solution representative otherwise veteran has actually?

Response: There is absolutely no restrict until entitlement try maxed out. For example, the brand new county conforming financing restrict is $548,250 to have a single house for the majority areas, while gotten your own earlier in the day loan to have $300k thus then you’ve got 248,250 left out of a great Va Loan amount buying a separate family.

Q8: How many times can also be just one solution representative lso are-explore the Va entitlement?

Response: In case the homes can be purchased then i don’t have a threshold. There’s a-one-big date restoration from entitlement. If a veteran refinances a preexisting family on a conventional or most other low-Virtual assistant Loan capable sign up for a-one-date restoration out of entitlement. The object to consider would be the fact this is certainly a single-day fix very make sure you utilize it the best way you’ll. Such, when you yourself have an excellent Virtual assistant home loan with the property having $500k and you’re PCS’ing so you’re able to Virginia and would like to get a fourplex to have $dos billion toward good Va Loan, you might first must re-finance one past family toward an excellent conventional loan, pay it off, or sell, in order to free up their entitlement. A negative analogy might possibly be if someone refinanced a beneficial Va mortgage to possess an excellent $100k for the a conventional financing and simply wished to choose the 2nd house getting $250k. Over the past analogy new Seasoned got adequate entitlement to bring one another funds at the same time and you may wasted around you to definitely repair.