- Lifestyle at the WMC

- In the news

- Home Life

- Mortgage Maxims

- Industry and you may Industry

- Broker Tips

Knowing the schedule getting home financing approval (and you can and this facts you can expect to slow down the method) helps you get ready for the brand new homebuying feel.

When you’re ready to get a house, it appears as though their closure go out can not come eventually. However, even with you find property, generate an offer, and also have the good thing that your particular offer is approved, you have still got more opportunities before you can found your new house keys.

But there is good payday loans Brush news: when you yourself have an elementary comprehension of the borrowed funds approval process, how much time it might take, and just what things you will automate the procedure, youre a stride nearer to a mellow, streamlined loan sense.

Just how long Does the borrowed funds Approval Processes Grab?

An average of, the loan acceptance procedure requires 30 to two months – although it is going to be somewhat less or offered, with respect to the problem.

While pre-approved or borrowing pre-approved for a financial loan before you start the house searching procedure, their mortgage you’ll close-in as low as two to three months once their offer try recognized on the a house.

Having good pre-recognition at hand, you’ll likely has an easier family looking feel, and you may submit also offers with full confidence – knowing that a reliable home loan company has already reviewed your financial condition.

Look at it this way: having a beneficial pre-acceptance, you and your lender was installing much more effort upfront – however, that means that you’ll probably provides a more smooth, quick home loan techniques, as compared to a great homebuyer who is not pre-recognized.

Just what Could Decrease My Financial Approval?

Regardless if you are pre-acknowledged or not, the mortgage process would be defer by different items. For individuals who transform jobs, have a general change in your revenue, or even create a life threatening purchase (such as for instance a car otherwise furniture) inside the approval processes, the borrowed funds acceptance is put off otherwise refuted.

In the event the lender needs most records from inside the mortgage recognition and you may that you don’t offer it in a timely manner, this will plus significantly delay the borrowed funds closure.

Most other waits into home loan process relate to the latest possessions itself. If for example the family review reveals an enormous problem, including mildew and mold, architectural issues, and other big defense issues, these can push back the fresh closing date up until he’s treated. Issues with the new assessment also can trigger delays; if the appraisal value cannot exceed the fresh property’s profit rates, the mortgage process is switched off.

Legalities on household identity or deed (such as for example outstanding fees or liens toward possessions) try a different sort of difficulties that may delay a mortgage closing.

And additionally, contingency problems can be put the financial acceptance behind plan otherwise result in the money to fall thanks to completely. As an example, should your consumer possess a backup one to claims they should sell the newest property before purchasing their 2nd house – and this doesn’t occurs into the specified timeframe – the loan due to their brand new home was affected. An alternate example of a backup a failure certainly are the consumer’s failure so you can secure homeowners insurance through to the closing.

Exactly what can I do in order to Automate My personal Financial Approval Techniques?

Aside from getting pre-accepted, there are a few things to do to aid the fresh financial process circulate along easily, including:

Check your Credit score beforehand

First the loan acceptance processes, opinion your credit score to be sure there are no problems (this happens more frequently than your erican people available at least one mistake within their credit file, according to research conducted recently of the Individual Profile. Such mistakes normally slow down the borrowed funds processes and also jeopardize your mortgage acceptance. An additional benefit off once you understand your credit rating would be the fact it does make it easier to narrow down and that mortgage brokers you may want to be eligible for – saving you more hours as you prepare to choose a mortgage.

Become Totally Honest Along with your Mortgage Maker as well as their Group

Whenever exposing debt pointers into acceptance procedure, be certain that you’re transparent. Recognize one things which can apply at your loan approval, instance later bank card money, even more channels of cash, etc. This will help your own chip and you may underwriting people move quickly because of debt recommendations – without any surprises in the act.

Expect you’ll Offer A lot more Documents As quickly as possible

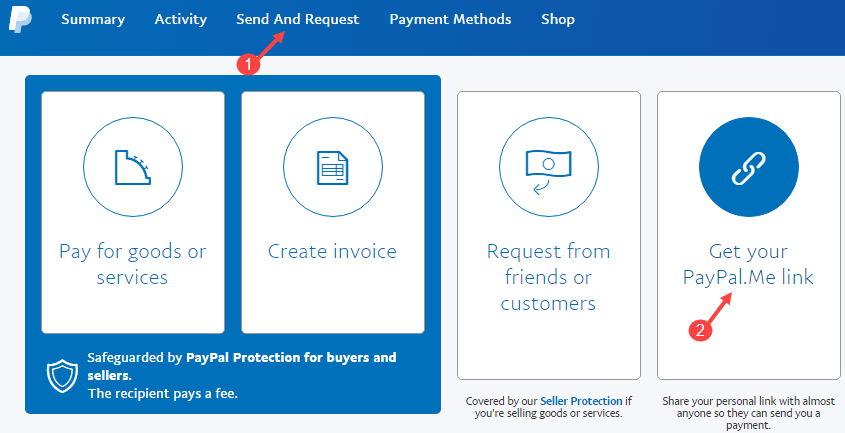

As the mortgage procedure is exclusive to any or all, chances are high probably the extremely waiting borrowers will have to provide an additional file otherwise a couple in the exact middle of new journey. If your lender’s class asks for a file, be prepared to posting it as in the future as possible. (Since the a side note, make sure to choose a loan provider enabling you to definitely securely and you may quickly publish records electronically – that can rescue even more time. During the Waterstone Home loan, i’ve an exclusive, all-in-one to program titled Feature, enabling our very own subscribers to complete that.)

Given that financial recognition process is complex, it is very important work on a reliable mortgage elite who’ll guide you owing to each step, to help you avoid pricey delays and progress to the new closing table promptly.