The concept of equivalent units is defined as the number of units that would have been produced given the total amount of manufacturing effort expended for a given period. Multiply the cost per equivalent unit by the number of equivalent units for each category of units accounted for. In the weighted average method, we divided total costs by total Equivalent Units, but here is where the FIFO method is significantly different. Under the weighted average method, we use beginning work in process costs AND costs added this period.

What are the limitations of equivalent units?

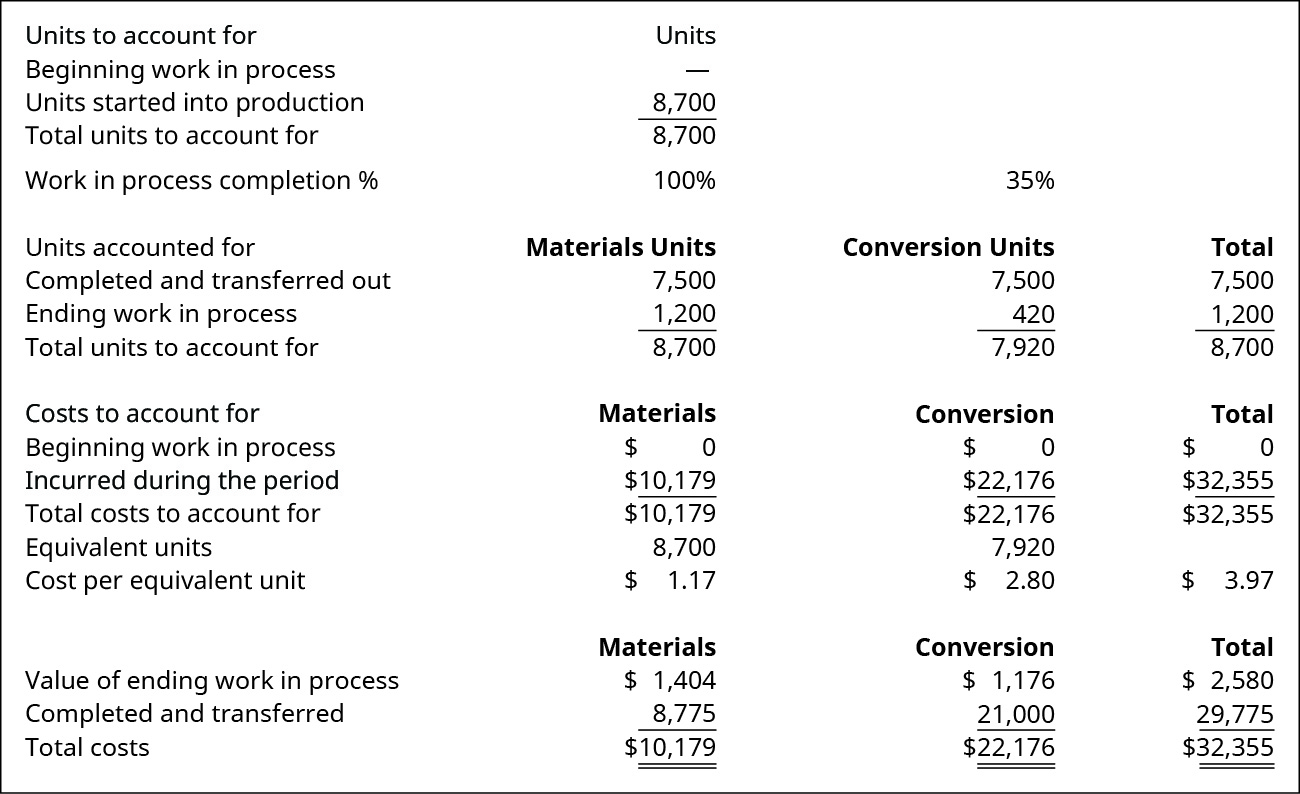

Ending work in process is 1/3 complete for conversion costs, but what about materials? Now you can determine the cost of the units transferred out and the cost of the units still in process in the shaping department. The total materials costs for the period (including any beginning inventory costs) is computed and divided by the equivalent units for materials. The total of the cost per unit for material (\(\$1.17\)) and for conversion costs (\(\$2.80\)) is the total cost of each unit transferred to the finishing department (\(\$3.97\)). The total of the cost per unit for material ($1.17) and for conversion costs ($2.80) is the total cost of each unit transferred to the finishing department ($3.97).

Ask Any Financial Question

We do this because it is easier to account for whole units then parts of a unit. For example, if we have 3 units 1/3 of the way complete, we can add them together to make 1 equivalent unit (1/3 + 1/3 + 1/3). We can make this calculation easier by multiplying the units by a percentage of complete.

What are Equivalent Units of Production (EUP)?

The beginning work-in-process was valued at $66,000, consisting $20,000 of transferred-in costs, $30,000 of material costs, and $16,000 of conversion costs. In this case, the equivalent production for opening work-in-progress in the period is 300 units (i.e., 500 x 60%). Unfinished units (work-in-process) in this department have to be converted to Equivalent Units.

- For example, if we bring 1,000 units to a 40 % state of completion, this is equivalent to 400 units (1,000 x 40%) that are 100% complete.

- Finally, the equivalent units of production calculated via the previous three steps should be aggregated to ascertain the total output in terms of equivalent units or equivalent production.

- This report shows the costs used in the preparation of a product, including the cost per unit for materials and conversion costs, and the amount of work in process and finished goods inventory.

- In the case of chocolate bars, WIP means the bars that are partially made and not ready to be sold.

- Accountants often assume that unitsare at the same stage of completion for both labor and overhead.Accountants call the combined labor and overhead costs conversioncosts.

All of the costs incurred during the period would be allocated to the goods because they were all completed. Once the equivalent units for materials and conversion are known, the cost per equivalent unit is computed in a similar manner as the units accounted for. The costs for material and conversion need to reconcile with the total beginning inventory and the costs incurred for the department during that month. First, we need to know our total costs for the period (or total costs to account for) by adding beginning work in process costs to the costs incurred or added this period.

Step 1 of 3

The percent complete can be different fordirect materials, direct labor or overhead. For the shaping department, the materials are 100% complete with regard to materials costs and 35% complete with regard to conversion costs. The 7,500 units completed and transferred out to the finishing department must be 100% complete with regard to materials taxing working and conversion, so they make up 7,500 (7,500 × 100%) units. The 1,200 ending work in process units are 100% complete with regard to material and have 1,200 (1,200 × 100%) equivalent units for material. The 1,200 ending work in process units are only 35% complete with regard to conversion costs and represent 420 (1,200 × 35%) equivalent units.

We could then add these equivalent units to the ending WIP inventory for process 1. Any units that have been moved into process 2, will be subtracted from the WIP inventory for process 1. Under the weighted average method, costs transferred in from last month are added to this month’s costs and distributed across all units. This is the simplest way to account for beginning inventory costs, but not always the most accurate.

InDepartment B, the ending units may be in different stages ofcompletion regarding the materials, labor, and overhead costs.Assume that Department B adds all materials at the beginning of theproduction process. Then ending inventory would be 100% complete asto materials since we received all materials at the beginning ofthe process. We will calculate a cost per equivalent unit for each cost element (direct materials and conversion costs (or direct labor and overhead). FIFO, WA, and EU are all tools used to calculate the cost of producing products. Equivalent units help measure the production activity by converting partially completed products into an equivalent number of fully completed products. The FIFO method uses these equivalent units by assigning the oldest costs to the units completed first, which helps track costs in the order they were incurred.

The company had 750 shells in process at the close of business on January 31. The beginning inventory of 750 plus the 3,250 pie shells worth of materials placed into production during the month gives us 4,000 total units to account for. As described previously, process costing can have more than one work in process account. Determining the value of the work in process inventory accounts is challenging because each product is at varying stages of completion and the computation needs to be done for each department.