Pros lenders likewise have alot more easy borrowing from the bank conditions than just old-fashioned money, causing them to a selection for veterans which have less than perfect credit.

Expert Rates

A separate advantage of an effective Virtual assistant loan would be the fact it has aggressive rates of interest. Mainly because money is backed by government entities, loan providers also provide pros that have lower interest rates. This may help you save several thousand dollars along side lifetime of your loan.

Case in point: while to invest in an effective $3 hundred,000 house or apartment with a thirty-year mortgage, an effective .5% upsurge in the interest rate might cost your an extra $34,000 over the life of the borrowed funds!

Refinance Choices

Veterans may take advantage of the VA’s Rate of interest Prevention Refinance mortgage (IRRRL) system, which allows one to refinance your current Va mortgage in order to reduce your interest and you may payment per month.

One of many great benefits away from an excellent Va mortgage is the fact it can be utilized many times. If you have already made use of their Virtual assistant home loan benefit and just have since paid off the borrowed funds, you could potentially nonetheless use it once more to acquire a special domestic.

You may want to have fun with pros home loans to refinance a current financial, that may help you reduce your monthly installments and you can spend less over the years.

No Private Home loan Insurance rates

Private Mortgage Insurance policies, or PMI, is an extra expense you to some borrowers have to pay if the they don’t have an enormous sufficient down payment or if its credit rating must be large. This will help you save several thousand dollars across the life of your loan. You don’t have to love which extra cost which have an effective Va financing.

Very regardless if you are a first-go out homebuyer or a skilled homeowner, a Virtual assistant home loan makes it possible to reach finally your dreams of homeownership.

step 3. How must i policy for an effective Va Mortgage?

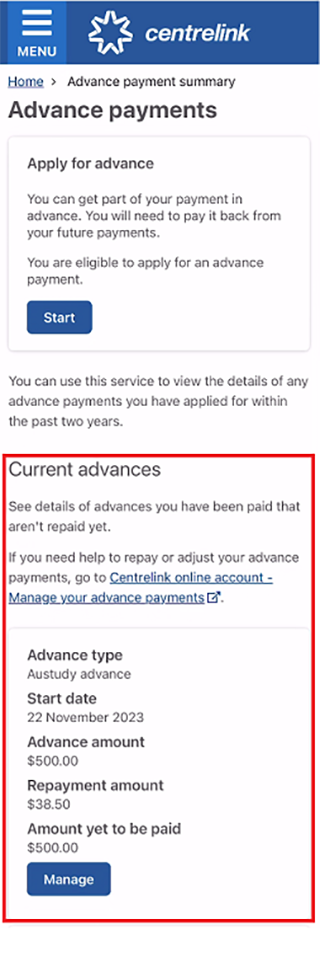

Planning very first house purchase might be daunting, particularly for pros seeking to use good Virtual assistant loan. If you are intending on the to order a home anytime soon, cost management for your house is a great idea.

Simply how much home are you willing to pay for?

Before also considering belongings, delivering pre-recognized having an effective Va mortgage can be helpful. This can give you an idea of maximum loan amount your qualify for, that will help you influence your allowance having property.

There’s absolutely no max Virtual assistant loan amount on the Virtual assistant, although not, your own financial only allow you to borrow a specific amount centered on the problem. However, no matter if a lender pre-approves your to possess a leading amount, you could however get a home on an alternative price point. Ensure that you’re confident with brand new monthly payment, together with your mortgage, insurance rates, and you may property taxes.

Believe and you will Rates

You cash loans Malvern AL to crucial foundation to take on ‘s the interest rate on your own financing, as you are able to somewhat effect their monthly mortgage payment. If you’re repaired-rates mortgages promote balances and you may predictability, it is essential to understand that rates of interest vary over time.

Plan for Even more Expenses

At exactly the same time, believe other costs associated with buying a home, such closing costs, assets taxation, and homeowner’s insurance policies. You may also be required to pay a Virtual assistant money commission (regarding that it lower than).

Setting aside some funds to own unexpected expenses otherwise fixes that may developed once you move around in is also best. By firmly taking the full time to help you bundle and budget now, you can make household-to purchase procedure more under control.

cuatro. Are I eligible for pros mortgage brokers?

Before you apply for good Va financial, it is very important see the eligibility conditions and you can crucial affairs one could affect your loan.

Provider Conditions

To-be eligible for veterans home loans, you must have offered on armed forces on Energetic Duty, on the Reserves, or in new Federal Protect. Your discharge must be aside from dishonorable.