Just what affects whether or not I’m approved getting the next mortgage?

Contrast mortgages having Uswitch

2nd home loans is actually for those who need to pick an additional assets for their very own use since the a holiday domestic, is closer to work during the week and for an excellent family member, including rather than to rent out, then you definitely will need a purchase-to-help mortgage .

It functions in the same way because a primary home loan, only with stricter cost monitors, since investing in an additional mortgage can add tall monetary filters.

So, if you’d like to rating a mortgage to possess an additional home just be yes your bank account can be found in a beneficial purchase. You’re visiting the termination of and also make your instalments on your own first-mortgage and be you could conveniently take on another mortgage, eg.

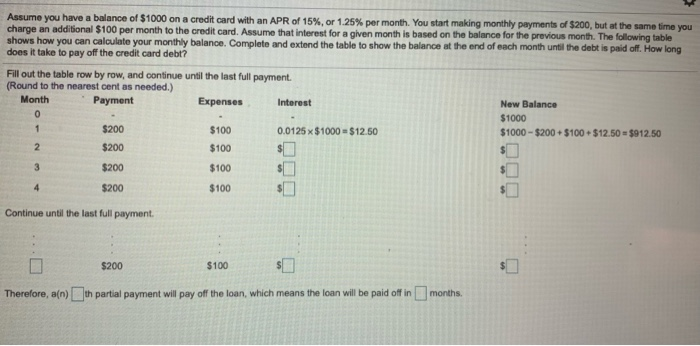

You can make use of another mortgage loan calculator observe just how much you might use and what the payments will in all probability feel.

If you’re looking to apply for one minute financial since you will be gonna buy several other household otherwise apartment it’s possible to perform thus. You’ll have a few mortgage loans powering at the same time as much time as you are able to be able to spend the money for monthly instalments into all of them.

A second financial on another home is some other much time-title loan on your label stored against the new assets you are to get, separate into existing you to.

A moment real estate loan is not the identical to a guaranteed loan, remortgage otherwise 2nd charge financial, and that confusingly can also be also known as a good second mortgage’.

อ่านเพิ่มเติม →

/Front-of-Card-56a066745f9b58eba4b04461.png)