to create an order at a selected price with one click. The engines job in this case could be to hear on the Kafka command topic, execute the command on the order book and publish the result on the occasions subject. For a buy order, this means that if I place a purchase order at the price of $100, it’ll get filled at any price bellow or equal to $100.

Two of crucial decisions on the journey to upgrading or establishing a brand new trade are understanding the out there know-how and choosing the right change expertise associate. EP3 makes use of modern technologies, together with Kubernetes, Kafka, and MongoDB, to allow fast responses to market activity spikes. We supply customized software improvement services that can assist you meet your operational and enterprise objectives.

Limit orders are essentially the most commonly used orders within the present crypto exchange environment. The order e-book is a list of buy or sell orders sorted by worth and timestamp. First, you should understand all the ideas concerned and what each sort of order does, so let’s take them one by one. We want to enable large monetary establishments the flexibility to trade cryptocurrencies with full confidence and belief, whereas offering retail investors an equivalent safe framework. In order to incentivize specific behaviors amongst market players, the pro-rata algorithm is commonly blended with different allocation methods. We are currently benchmarking and evaluating a set of rules which could be supported on the LGO exchanges.

Buying And Selling One Hundred And One: What’s A Commerce Matching Engine And The Way Does It Work?

The match engine employs algorithms to fulfil orders based on parameters like price, volume, and time of order entry. An order-matching engine structure uses various standards to match orders, including value and time, order sort, and buying and selling venue. These engines assist in linking purchasers with sellers and promote trades by comparing their orders to find best matches. Match engines’ significance cannot be overrated, and a thorough comprehension of their perform is essential for everyone concerned in buying and selling. The capability to course of orders rapidly is crucial, particularly in a panorama the place each millisecond counts. The payment structure is one other issue to think about when choosing a matching engine.

The first thing that involves thoughts when speaking about software program is pace and efficiency. Surely, the liquidity of an trade also impacts buying and selling speed and effectivity. However, a trade matching engine allows high-frequency buying and selling utilizing a posh algorithm system. Centralized matching engines supply real-time matching with outstanding speed and effectivity.

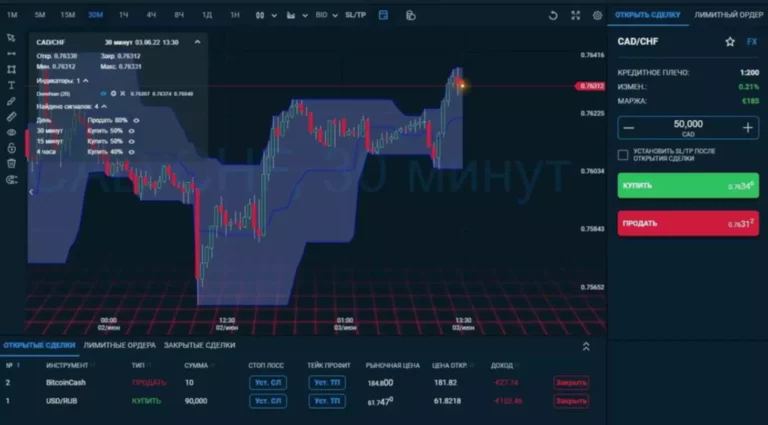

Professional Gui

TeraExchange was unable to scale and innovate with their existing provider’s answer. Connamara labored with the exchange to construct and launch a future-proofed SEF with state-of-the-art self-healing capabilities that enable the exchange https://www.xcritical.in/ for scalability. Integrate EP3 with third-party or proprietary market access and trading purposes. EP3 provides deployment flexibility across cloud, hybrid-cloud, and on-premises environments.

Electronic cash establishments dealing in bank deposits, digital fund transfer, cost processors and cryptocurrency depend on an automated matching engine to facilitate digital transactions. For example, if you place a buy 2 Ether order it could possibly get executed at $900, $1000, $2000 or some other value depending on the current open orders out there. Market orders are limited only by the number of funds the consumer has and the quantity of assets he wants to buy/sell. In the 2nd article of this serie, we’ll see how matching engine algorithms can be utilized to manipulate the market and led to unfair conditions. EP3 has the pliability to accommodate non-standard assets in a central restrict order e-book, empowering merchants with price transparency and discovery for a diverse range of property. EP3™ is built on a microservice-based structure that leverages the most recent in application containerization and orchestration technologies.

These kinds of orders are triggered when a inventory overtakes a specific worth point. Beyond this value level, cease orders are become market orders and executed at one of the best value available. We just need to connect with the Apache Kafka server and start listening for orders.

Price/time Algorithm (or First-in-first-out)

You can rest assured that EP3 lets you keep a clear and compliant change operation. Upgrade to a modern trade platform and tech stack, substitute outdated expertise, take your change to the cloud, or speed up your growth into non-traditional markets. Prioritizing excessive performance, EP3’s advanced matching engine know-how sustains an order rate of up to one hundred twenty,000 orders per second with an average latency of fewer than 8 microseconds.

A variety of HFT phrases have their origins in the computer networking/systems industry, which is to be expected on situation that HFT relies on incredibly fast laptop structure and state-of-the-art software. We briefly talk about beneath 10 key HFT phrases that we believe are essential to realize an understanding of the subject. Here at Theorem, we satisfaction ourselves on offering customers the flexibility to effectively allocate and match transactions. We consider it’s essential for each market participant to grasp the worth behind Trade Matching… that’s why we created The Ultimate Guide to Trade Matching.

Share

This improvement introduced an era where anybody can commerce virtually any asset from the consolation of their residence. Each has its personal benefits and disadvantages, so it’s worth contemplating which one could be greatest on your needs. Enterprise wallets options that provide your prospects Bitcoin, Ether, Ripple`s XRP, Bitcoin Cash, Litecoin and more as a cost choice. Puts a block on benefiting from worth differences between two or extra markets. FIX API can be utilized to attach your trade to an ©aggregated liquidity pool or various exterior sources for feeds solely.

The algorithm applied by the matching engine is the vital thing element in what behaviour we need to incentivize within the trade. In the next sections, we’re going to focus on the 2 most popular implementations of theses algorithms. Connamara successfully delivered the AFX change platform, ready for launch, in December 2015, and continues to offer ongoing engineering and platform assist for the exchange.

By default, an identical engine will at all times try to find the most effective price available (2) for a given order (1). Connamara, at the aspect of a neighborhood companion, delivered a solution to transition production to a platform inside the home nation on a good timeline. After intensive planning, benchmarking and launch, the system carried out well without any interruption to trading on the change. Rapidly launch global exchanges for important commodities or sovereign instruments with effectivity and reliability. EP3 is designed to empower leaders in emerging markets to shortly set up their presence.

Many sources are available for connection with B2Trader ensuring the ultimate liquidity solution. Around25 is a bunch of really passionate fullstack developers who’re rising a product improvement agency. Passion means we at all times hone our craft, enhance our product & enterprise know-how, sustain with the news. Its objective is to teach and help others who’re fighting constructing their own change.

EP3 provides exchange operators a view into the well being of their platform, so they can tackle problems earlier than they influence the market. EP3 provides further functionality to allow exchange operators to determine market exercise that is detrimental to the integrity of the exchange. EP3 is self-healing, so if one matching engine inside the trade fails, order circulate is automatically rebalanced throughout the remaining engines to make sure availability. Minimize disruptions to buying and selling and meet the demands of recent 24×7 markets and regulatory requirements. Advanced features, conceived by capital markets specialists, guarantee EP3 is scalable, reliable, and resilient.

- Around25 is a bunch of really passionate fullstack builders who’re rising a product improvement agency.

- The matching engine relies heavily on processing energy to match the trades and calculate the model new amounts for each matched order.

- EP3 offers cloud, on-premises, and hybrid internet hosting choices with dynamic scaling, permitting you to maintain tempo with quantity and order fluctuations — while scaling your costs as you develop.

- Although matching engines are sometimes overlooked, they stand as a testomony to the precision and class underlying fashionable trading platforms.

- The matching engine is definitely a key component to “build trust” in our new technology buying and selling platform.

- brokerage platforms.

The remaining orders will turn into the “order book” for the subsequent order obtained by the matching engine. Our highly effective, asset-agnostic know-how serves recognized asset classes and a broad range of belongings that have never been exchange-traded before. Real-time and end-of-day alerts help change operators detect unusual activity. EP3’s built-in market surveillance tools reduce complexity by enabling you to trim the variety of third-party tools related to your platform.